LatAm Fintech Regulatory Framework

Leer versión PDF

LatAm Fintech Regulatory Framework

CONTENTS

Background ………………………………………………………………..4

Argentina…………………………………………………………………….5

Boliva …………………………………………………………………………7

Brazil ………………………………………………………………………….9

Chile …………………………………………………………………………11

Colombia…………………………………………………………………..12

Costa Rica ………………………………………………………………..14

Dominican Republic …………………………………………………..16

Ecuador…………………………………………………………………….19

El Salvador………………………………………………………………..20

Guatemala…………………………………………………………………22

Honduras ………………………………………………………………….24

Mexico ……………………………………………………………………..34

Nicaragua………………………………………………………………….26

Panama…………………………………………………………………….27

Perú………………………………………………………………………….28

Uruguay…………………………………………………………………….30

Venezuela………………………………………………………………….32

Andersen Global

Andersen Global® was established in 2013 as an association of legally separate, independent member firms, with a worldwide presence and comprised of professionals that share a common background and the same vision no matter the location.

Our growth is a byproduct of the outstanding client service delivered by our people – the best professionals in the industry. Our objective isn’t to be the biggest firm, it is to provide best-in-class client services in a seamless fashion across the globe.

Our professionals are selected based on quality, like-mindedness, and commitment to client service. All of our Andersen Global professionals share our core values.

Andersen Global was established to create an enduring place – ONE FIRM where clients across the globe are afforded the best, most comprehensive tax and legal services provided by skilled staff with the highest standards.

Outstanding client service has and will continue to be our top priority.

Discover all the member firms and collaborating firms of Andersen Global at: global.Andersen.com

Core Values

Background

In recent years, Latin America has become an important region for the development of Fintech at the global level, considering Nubank’s

IPO as one of the most relevant milestones in this sector. This Brazilian technology financing entity has been valued at USD $33 billion and has more than 30 million customers with clear and dynamic growth in new markets.

Along with the development of Fintech in Brazil, which proves to be spearheading the Fintech boom in Latin America, we see a clear

development in new markets such as Mexico and Colombia, in which several Fintechs have achieved valuation levels that places them at Unicorn status.

This way, we see that Latin America is presented as fertile territory for the entities that offer financial products and services using communication and information technologies, as well as those that act as intermediaries in transfers,loans and purchase and sale of financial services, considering the limited competition that had existed in the market recently.

This has translated in the facilitation of current financial operations, as well as, being based on innovative and even disruptive technologies, the possibility of offering entirely new financial products, as well as a greater range of operations and customers such crowdfunding structures, business-to-business and peer-to-peer operations or even microloans, thus reaching a far greater market.

However, this does not come without risks. As counterweight, there could be greater vulnerability due to the own nature or dependence on technology, as well as greater risks from the innovation or flexibility in the offering or business models, which leads to a need for

greater regulation. Similarly, from a tax perspective, as we have seen in the technology or digital industry recently, there is difficulty in applying tax provisions created based on traditional business models to these new structures, models and transactions, which may not be clearly foreseen or even defined.

Due to the relevance that this market has and will have in future years, this report seeks to provide a general overview of the regulatory and tax framework that is in effect in the different countries of Latin America that have made progress in this process, such as Mexico, with the publication of the Fintech Law in 2018 and Brazil with the approval of the Open Banking project in 2019, as well as the future perspectives that participants in this market should consider given the constant evolution of the legal framework in the different countries of the region.

ARGENTINA

Andersen in Argentina

Member Firm of Andersen Global

Legal Framework of Fintech in Argentina

At the moment, the Central Bank of the Republic of Argentina is the organism that rules the Fintech’s activities in order to obtain

a more transparent system and boost the users’ protection in their financial inclusion.

Between the most important rules we can highlight the following:

• Creation of a virtual uniform code to identify and track transfer, easing the operability between different accounts and pay services.

• Definition of pay services supplier (PSP) and pay accounts, forcing them to register for to can operate.

• Creation of an information regime for PSP, regarded pay accounts of clients that they manage, as well their fiscal data and balances.

• Establishment of a Transfer Program 3.0, in order to expand the scope of immediate transfers and build an open pay digital ecosystem that integrates the financial industry and Fintech, giving an important cost reduction of each transfer. At least, using the same QR allows for possibly making payments from any bank account or virtual wallet.

Also, the National Securities Commission and the Internal Trade Secretary take part in this process, through the Resolution and the Consumer Defend Law that regulate the electronic trade of services and goods.

Finally, we highlight that the Fintech can not intermediately capture and affect publics found, (while the Financial Entities can do it) and the employers cannot use those accounts for pay their employees’ salaries.

Tax Framework of Fintech in Argentina

There are no specific tax rules to apply for Fintech, so we must apply the general rules.

The income earned by Fintech residents in Argentina, either local source or foreign source, is taxable with the income tax, applying a progressive rate (from 25% to 35%) depending on the income earned in each fiscal period.

Regarding the Value Aggregate Tax (VAT), the interest, commission, and services that Fintech give are levied with the 21% general

rate. In some cases, one would be able to apply a reduced rate of 10.5%.

When Fintech are constituted like companies ruled by Law 19.550, they must be substitute responsible by personal assets tax regarding equity share of human persons and foreign company. The tax rate is 0.50% and it must apply over the company’s equity amount to December 31 of each fiscal period.

Regarded information regimes, the General Resolution of AFIP N° 4614/2019 set two regimes: one of them is related to the commission that pay services processors collect through digital platforms and the other is related to the management and intermediation

services of services accounts and virtual wallets.

The bank debits and credits tax apply over the bank accounts credits and debits, transfer, and other movements of founds that don’t

use the bank accounts. The general rate is 6% for bank debits and bank credits and 12% for the rest of operations. Recently, the

Fintech’s paid account (virtual wallets) were levied by the mentioned tax with some considerations. Although the reglementary decree

set some applicable exceptions over different situations.

The gross revenue tax is a provincial tax and levied the habitual and onerous activities of Fintech. The tax is calculated over gross

income accrued during each fiscal period and the rate depends on each jurisdiction.

Future Legal Framework As a consequence of the exponential increase of Fintech last year ago, the Argentina Fintech Camara submitted some guidelines for the new legal framework, that include virtual assets in the traditional system and to let the incorporation of Fintech industry to knowledge economy promotion, in order to reduce the tax cost.

Bolivia

Indacochea & Asociados

Collaborating Firm of Andersen Global

We understand Fintech as the use of technology when offering financial products and or services, either through mobile applications

and/or web platforms. Fintech covers a new wave of companies that reduce costs and simplify procedures, offering a more dynamic

and efficient service, favoring financial inclusion and access to credit, payment methods, personal finance, loans and investments by

and for individual and/or corporate entities.

That said, we can evidence that the essence of Fintech companies is to make life easier for users by speeding up and simplifying the

financial processes such as: (i) apply for an online loan, (ii) currency exchange or (iii) make a payment, among others; in other words, to

improve the user’s experience. Technology is the best ally of any of these companies that are generating a deep change in traditional

banking, introducing alliances and challenges for the financial industry that will have to be taken as the turning points that will generate a complete change in relation to the banking we are used to.

When we talk about change, the industries that had the greatest disruption were those linked to sending money and payments, which led to the birth of different companies in the Bolivian Fintech Ecosystem. Currently, this industry is under the eyes of the Venture Capitalists and the investment world, attracting talent from traditional banking which, despite including new services related to their

adaptation to technology, is still governed by the usual operational and hierarchical structure.

According to Article 331 of the Political Constitution of the Plurinational State of Bolivia, it establishes that financial intermediation activities, financial services and any other activity related to the management, use and investment of savings which are of public interest, may only be exercised with prior authorization from the State. Likewise, the Central Bank of Bolivia (BCB by its acronym in Spanish) has full capacity to regulate the Payment Systems of the country with the purpose of promoting security and efficiency of funds transactions between natural and/or legal persons.

This being said, paragraph III of Article 8 of Law No. 393 of Financial Services establishes that the Financial System Supervisory Authority (ASFI by its acronym in Spanish) will issue specific regulations and supervise the financial systems as well as the stock market activity.

Likewise, the authority recognizes those companies that give this kind of complementary financial services. However, companies

engaged in the provision of these services, must have an Operating License granted by the ASFI and comply with the authorization

determinations.

The lack of regulation and updating of the current regulations in Bolivia, regarding financial activities provided via digital and technological resources, forces some Fintechs to develop their activities in the so-called loopholes granted to them. This prevents the efficient takeoff of these financial technology companies but does not stop them from continuing to disrupt the market by offering technological solutions that enable financial inclusion, granting a role to all actors who wish to be part of the ecosystem.

With the growth of the industry by leaps and bounds worldwide, a good investment outlook is projected for Latin America and Bolivia, the latter having a wide market margin and a promising niche. This leaves us with an open gap to continue creating and innovating.

As we wait and see how this scenario will evolve, it is important to promote innovation and growth of digital companies within a single market and ensure the user’s confidence and security. That is why, in Indacochea & Asociados we have specialized lawyers in the Fintech field and we care about understanding and comprehend the needs of our clients who are engaged or plan to venture into the Fintech ecosystem, guiding and taking them by the hand in each of the stages of their vision.

Brazil

Lotti & Araújo

Collaborating Firm of Andersen Global

Albieri e Associados Collaborating Firm of Andersen Global Fintechs in Brazil Since 2008, Fintechs have been emerging in Brazil and there are now a relevant number of companies. At this moment, according to a survey by Fincatch, which is a platform for

evaluation and consultation on the reputation and information of Brazilian Fintechs, there are more than 1509 startups of this type in

Brazil. Currently, we have Fintechs operating in all regions of the country, but there is accentuated concentration in the Southeast region (72.3%), in cities such as São Paulo and Rio de Janeiro, compared to other cities in the world, São Paulo ranks 4th in numbers

of Fintechs.

Legal Regulation

In the current Brazilian scenario, Fintechs operate in accordance with resolutions 4.656, 4.457 and 4.658 issued by the Central Bank of Brazil (BACEN), as well as Complementary Law (LC) 167/19, that created the Simple Credit Company (ESC) and Law 10.194/2001, that deals with the Credit Company for Micro-entrepreneurs and Small Businesses (SCMEPP), but there is still no specific law dealing with the topic, which is still being debated in Brazilian legislative houses.

Resolutions N.º 4.656 and 4.567 of the Central Bank (BACEN)

Resolution 4.656 created two types of Fintechs: Inter-Personal Lending Companies (SEP) and Direct Credit Companies (SCD). The SCD may operate using its capital and on some occasions may use resources of the National Bank for Economic and Social Development (BNDES), while the SEP may operate raising funds from the parties involved as an intermediary, resembling the operations that are carried out by traditional financial institutions. Both must be incorporated as joint-stock companies and must comply with Law 6404/76 (Joint-Stock Companies Act). They also need to have a minimum share capital of BRL 1 million. Resolution 4,567

establishes that Fintechs can be controlled by national or foreign investment funds and authorizes the sale of credit rights and securitization without the need for the intermediation of a bank or financial institution, as was previously required.

Complementary Law 167/19 and Law 10.194/2001

The Simple Credit Company (ESC), created by Complementary Law 167/19, unlike the others, does not need authorization from BACEN for its operation, however it is limited to act in municipal and district areas, and must always be constituted in the form of EIRELI or LTDA. and has its activities focused only on loans, financing, and discount of credit title. On the other hand, the Credit Society to the Micro-Entrepreneur and Small Business Company, incorporated under Law no. 10,194/00, requires authorization of BACEN to approve its operation, must be instituted in the form of LTDA. or Limited Liability Company, must also respect the minimum paid-up capital of BRL 1 million, and its activities are directed towards financing to micro-companies, individuals,

credit analysis and collection.

Resolution 4.658 and the Brazilian General Data Protection Law (LGPD)

Resolution 4,658 defines policies for digital security, personal data protection and incident response with respect to the use of outsourced cloud servers, without prejudice to the rules contained in the General Data Protection Law (Law 13,709), non-compliance with which can lead to severe penalties, as it deals with personal data of customers, including sensitive data. The Advance of Fintechs Considering the needs generated by the COVID-19 pandemic, some changes were made in the SCD regulations, expanding its role in the market, allowing it to operate with BNDES resources, which was not possible until recently. It also allowed the issuing of credit cards and other post-paid instruments, expanding the products offered in the market to its clients. It also allows the cession of credit for several investment funds and, finally, the investment in capital by funds, having their total control, without the need to be linked to an individual or legal entity for that. Thus, despite the economic crisis that Brazil is going through due to the consequences left by the pandemic, the SCD Fintechs have become an increasingly sought-after alternative for credit generation, as the regulation advances,

which allows them to have a larger space in the market.

Conclusion

Thus, we see that Fintechs are an innovative and promising form of entrepreneurship, especially in Brazil, a country whose economy

has heated up and advanced when compared to others, despite the global crisis. The economic benefit of startups of this type is

positive and there is room in the market for an even greater advance, as the pandemic crisis comes to an end.

Chile

SPASA Consultores

Collaborating Firm of Andersen Global Chile doesn’t have any specific ruling about Fintech models. Nevertheless, a law project

created by the Financial Market Commission (CMF by its name in Spanish) contains the general definition for ruling certain aspects

of the Fintech businesses, such as crowdfunding and related services. According to the Commission, the current law in Chile is

inadequate for the new business models.

That can certainly be the case as the current regulations are bases on the traditional financial services, so a major percentage of the Fintech models are not regulated. Currently on the Senate, the Finance Committee is working on a project to regulate the industry in Chile. This project has already been approved in the House of Representatives (Camara de Diputados). The project seeks to regulate the Fintech startups, while lowering the risks for clients and investors and also allowing the starts up to work in their business.

This Fintech Law Project establishes a perimeter for the rulings in five main type of services, loan platforms, alternative transactions

systems, credit and investment consulting, custody of financial instruments, and routing of payments and instructions. This project tries

to improve the service provided to the final customer and or companies.

Colombia

Jimenez Higuita Rodriguez & Asociados

Member Firm of Andersen Global Fintech or financial technologies are technological innovations applied in the rendering of financial services and generate new applications, processes, and products. In other words, Fintech describes a business that seeks to provide financial services using software and modern technologies, such as apps for smartphones that allow bank clients to make payments and transactions without a credit or debit card and without having to attend a physical installation.

According to Colombian regulation, financial services can only be rendered by financial entities, meaning those entities expressly

authorized by the financial authority in Colombia (Superintendencia Financiera). In recent regulation, authorization was given for companies to implement technological developments to perform activities of financial entities, so they can incorporate a vehicle to perform such activities and will have an authorization for two years to operate temporarily.

In addition, Decree 2443 of 2018 authorized credit establishments, financial services companies, and capitalization companies to

participate in national or international companies whose legal purpose is to develop or apply innovation and technology related to

the legal purpose of the financial entities that are investing. Such companies will not be authorized to provide financial services but

can render their technological and innovative services to entities authorized to render financial services.

The financial authority in Colombia created innovasfc, the Financial and Technological Innovation Working Group of the financial

authority – Financial Superintendence of Colombia (SFC) created in 2017 to facilitate innovation in the financial sector. This group

accompanies innovation at the service of the financial consume, supports innovative developments that promote inclusion and

financial education, supports financial and technological development and innovation and promotes sustainable innovation.

To accomplish its objectives, innovasfc created methodologies such as the sandbox, hubs, and regtech. The innovation hubs are the ones that support, advise, guide and receive feedback from supervised and non-supervised entities on issues related to financial and technological innovation. It is the point of contact for the financial authority and those interested in the Fintech ecosystem.

It is also helpful for identifying regulatory barriers, hence it helps develop laws and draft its contents according to the reality of the Fintech industry. In the second place, the sandboxes are a space provided by the financial authority for the testing of technological and financial innovations in a controlled and supervised space. This space is available for the Fintech entities to test their products, business models, apps, etc. The idea is to keep a balance through an appropriate regulation that supports the new technologies.

This way, Fintech entities would be able to make a request process detailing its innovative project and the need for supervision of

the financial authority. Also, they will have to provide the information related to the means to protect the financial consumers and the

way to present the information reports and in case the testing is successful, its performance within the market will be allowed .

Costa Rica

Central Law

Collaborating Firm of Andersen Global

The term Fintech has aroused much interest in recent years for investors, financial institutions, academic centers, entrepreneurs,

and regulatory entities that seek to provide security to users of technological solutions. Costa Rica is no exception. Being the leading country in mobile penetration throughout the region (more than 1.5 smartphones per person), as well as its privileged position

in global rankings, have facilitated the development of various Fintech technologies.

Fintech Startups have found the opportunity to democratize access to financial services for a greater part of the population. In Costa Rica in recent years, several initiatives have been launched for financial inclusion with the aim of promoting banking in the country, however, specific strategies have not yet been implemented to promote the development of financial inclusion solutions through Fintech startups.

Fintech Regulation

Unlike countries like Mexico, Costa Rica does not have a law governing financial technology companies. Given this, the regulations that

apply to Fintech in Costa Rica will depend on what type of company it is. It can be a company that develops technology for financial

entities (traditional conception of Fintech), or one that, through technology, provides services like those provided by financial entities.

In some cases, the SUGEF Agreement 14-17 on Information Technology Management.

For other cases (technology between companies), requirements change. These must register with the General Superintendence of

Financial Entities (SUGEF) and comply with the SUGEF Agreements11-18 and 13-19, as well as the regulations, guidelines and

circulars issued by the SUGEF to that effect.

Additionally, they must comply with the implementation and practice of policies to prevent the risk of money laundering, financing of

terrorism and financing of the proliferation of weapons of mass destruction.

The provisions of the Personal Data Protection Law as well as the Consumer Protection Law could also apply to these companies.

Opportunity Areas

The entrepreneurial ecosystem in Costa Rica presents several areas of opportunity. The financial sector and potential investors have difficulty understanding the needs of entrepreneurs and how to help them at different

stages of development.

These types of technologies require combining 4 key factors: human capital, public policies, demand for services and regulation.

This scenario creates challenges for financial regulation, including consumer protection standards, prudent requirements (not excessive bureaucracy), which has made the adoption of regulations in line with technological growth difficult to implement.

Currently, the entrepreneur in Fintech areas does not have an easy way to access financing, even though there are available sources.

Dominican Republic

Pellerano & Herrera

Collaborating Firm of Andersen Global

Regardless that there is not a regulatory frame yet in the Dominican Republic for Fintech, it is relevant to point out that in the

last couple of years said sector has received a significant support by the financial and monetary authorities in the country aimed for

its formalization, such as:

a) On one hand, as part of the whole amendment to the Payment Systems Rules approved by the Second Resolution of the Monetary Board as of January 29, 2021 several provisions were included for its particular application to the vertical of digital payments; later in July 2021, the Dominican Central Bank published the instructions for the electronic payment entities and electronic payment accounts which pursues to establish the rules, guidelines and procedures of authorization applicable to the electronic payment entities.

b) On the other hand, more recently last February, through a joint initiative of the Dominican Central Bank, along with several Supervisor Offices such as the Banks Superintendence as well as those for the Stock Exchange Market, for the Insurances sector and for the Pensions regime it created the Dominican Republic Financing Innovation Hub with the purpose to support, provide dialogue and consultation to the interested parties – may them be regulated or not – in the development of technological innovations for the financial

sector.

As it has been expressed by the Dominican Central Bank Governor those governmental entities involvement in the hub is due to the

fact that many of those innovations require crossed regulations or it is anticipated that their operations may be beyond the scope of action of only one regulator. Therefore, the teamwork may improve the development of new products and services that may be

proposed by the Fintech sector and by those corresponding to different sectors.

In such sense, herein below we refer in a concise manner to several provisions inserted as part of the amendment to the abovementioned Payment Systems Rules applicable to the digital payment Fintech, as follows:

a) Electronic Payment entities and Payment Aggregates were included among payment services providers.

b) The Electronic Payment Entities figure is created which for its operations is subject to approval by the Monetary Board upon compliance of certain requirements set forth. These entities must have a sole object/purpose for rendering in a regulated manner, the payment services through use of technological solutions.

c) Inclusion of a payment instrument name electronic payment account which can be used through electronic platforms; said accounts can be handled by financial intermediation entities and by Electronic Payment Entities with the object to enable the public (may them be part of the formal banking system or not) to perform operations of electronic payments. Said accounts constitute a payment credential

in favor of the client in which it is stored a determined amount considered as electronic currency while the Rules specify that it does not constitute a deposit.

d) Enactment of the Electronic Payment Agent for the affiliation and funding of the electronic payment account. Among others,

pharmacies, hotels, supermarkets and banking subagents can act as Electronic Payment Agents.

e) The Payment Aggregator figure is created as that corporation that enters into agreements with other services providers to enable the acceptance of electronic payment instruments to its affiliates through the use of access devices or the use of Technology.

f) Said rules also include concepts such as, electronic currency, virtual asset, and mobile payment, among others.

In addition to the obligations established for Digital Payment Fintechs, it is important to mention that all Fintech, regardless of the

vertical under which they operate, as well as the INSURTECH, are subject to comply with general regulations such as industrial and

intellectual property legal framework, tax laws, money laundering and financing of terrorism, labor laws, social security laws, among

others.

Through the Dominican Republic Innovation Financing Hub, both Fintech and INSURTECH have access to regulatory guidance as well as orientation on the legal framework applicable to the operations to be implemented, which can be attained by means of contacting the different regulators of the Finance sector. Among the services they have access to you may find, getting advice, holding meetings and receiving guidance on their major legal and technical concerns; meeting with the HUB experts to discuss any ideas or queries on their respective projects; or even having its business proposal being analyzed under applicable legal framework to operate in the Dominican financial system. Such services are free to any innovative project that could impact the banking, insurances, pensions or stock exchange market systems.

Finally, in case any Fintech or INSURTECH may qualify (even during a certain period of time) as micro, middle or small tax contributors, they shall have access to certain benefits under the Dominican Tax Code or the Entrepreneurship Law, as follows:

• From a tax viewpoint, as a consequence of their operations they shall comply with its obligations before the tax administration, may it be, formal, withholding, perception or payment obligations as well as any other tax contributor being entitled to benefit from the Simplified Tax Regime (RST by its acronym in Spanish language) in which case they shall be released from paying the advance Income Tax, filling in of monthly forms on the Value Added Tax (ITBIS by its acronym in Spanish language) and from the Assets Tax (subject to such assets being linked to its economic activity), also they have automatic access to enter into schedule of tax payment agreements,

among others.

• Under the Entrepreneurship Law an Entrepreneurial Project is defined as the mise en scène of an idea through a new business structure or enterprise with the purpose to develop a certain product or service. Said law set forth a special regime for the improvement and formalization for the benefit of the companies that may be qualified under its scope. Among benefits granted, there is the simplification of administrative procedures before governmental agencies, to receive support and guidance by the Ministry of Industry and Trade; additionally, to have access to financing through FONDO CONFIE which acts as a first investm ent fund, created as a public trust. Such financing grants a special initial leave of 18 months free of payment of instalments, may it be capital or interests. It also grants exemption on the contributions to the Dominican Social Security System in the pension’s regime during the first three years

from incorporation of the entity depending on the type of corporate vehicle adopted which does not apply to middle size enterprises but only to micro and small ones.

ECUADOR

Andersen in Ecuador

Member Firm of Andersen Global

In Ecuador, 55 Fintech companies have reported, a growth of 243% from 2018. The segments in which there is greater development are mainly, the management of business finances (38%), digital payments, crowdfunding, digital currencies, and enterprise technologies for financial institutions. Within the digital payments segment, Payphone and Kuski stand out. Kuski began in 2017, and

expanded to Mexico, Chile, Colombia, the United States, Canada, and Peru. Its payment gateway registers around 75,000 transactions

per second and in 2021, it managed to capture more than USD $85 million in Series B financing round, becoming one of the firms

with the highest valuation, and USD $600 million in Latin America.

There are current regulations by the Superintendency of Banks that are part of the private sector the entities of auxiliary services of the

financial system, such as: banking software, transactional, transport of monetary and securities species, payments, collections,

networks and ATMs, accounting and computing and others qualified as such by the Superintendency of Banks within the scope of

its competence.

These companies qualified as auxiliary services of the public and private financial sectors in the financial activities that they carry out with the entities of these sectors, must observe and apply the rules on solvency, financial prudence, minimum physical and technological security and others issued by the Monetary and Financial Policy and Regulation Board and the Superintendency of Banks, in everything that applies to the service it provides.

In August 2021, a bill was presented in the National Assembly called the FINTECH Law, which is only a reform law to several legal bodies, and among its proposed objectives is to fill the lack of regulations, build resilient infrastructure and encourage innovation. It is also indicated in its recitals that a greater boost to the entrepreneurship ecosystem in Ecuador is necessary.

However, much skepticism and criticism of the Bill has been created, as it denotes an absolute ignorance of this type of venture, pigeonholing a series of service segments that have nothing to do with the financial system and consequently should not be regulated as such. There is no article that contemplates benefits, incentives, or promotion of this type of technological business, only control regulations.

The premise of the project would seem to be this: Before you start thinking, you must ask me for permission to do so and it is regrettable that it is intended to regulate ventures and technologies, limiting them, controlling them, and even sanctioning them before

even extending a birth certificate to those few ventures that manage to survive and subsist.

We hope that within the debates of the Assembly they will understand that in the case of technological initiatives and ventures, the best regulation is not to regulate them until their business model is clearly identified and then can be subject to supervision.

El Salvador

Central Law

Collaborating Firm of Andersen Global

Though El Salvador only recently hit headlines with its adoption of Bitcoin, it has had regulations that provide guidelines on the digitization of financial services and Fintech since 2015. The guidelines intend to incorporate as many users as possible and to push the banking sector forward.

The guidelines have two primary aims. The first, to integrate the unbanked section of the population into a more accessible financial

system, is widely accepted at the international level and allows more people to be creditworthy and enjoy a subsequent improvement in

their quality of life. The second is to establish additional guidelines regarding cryptocurrencies and the minimum requirements to be

met by companies interested in participating as suppliers within the financial system.

While the Law to Facilitate Financial Inclusion and its additional implementing regulations dictated by the Superintendent for the

Financial System, mark an important step in supporting the unbanked population, expanding e-money systems and providing

additional regulation for Fintech, it is necessary for this regulation to cover more areas in order to create new business opportunities in

a healthy, orderly way for users.

Why? Because Fintechs are much more than a product or traditional banking service provider. Fintechs also provide B2B services

and, importantly, cheaper transactions through multiple platforms. They could be used to develop safer transactions by establishing

minimum requirements on, for example, data encryption (even through Blockchain) and by integration into the existing digital regulation

(the Electronic Signature Act and Electronic Commerce Act). To do this, we believe it would be valuable to develop broader regulation covering more general aspects of the industry while taking care to avoid falling into overregulation, which in practice will make

technological developments impossible.

Some examples of this could be to support or encourage making transactions with existing cryptocurrencies, like Bitcoin, greater regulation of capital raising mechanisms (such as crowdfunding) as an alternative way of financing, and even the creation of

regulatory sandboxes as temporary spaces to carry out pilot tests of new regulation to measure its advantages, disadvantages and

inconveniences in a defined space where its effects are controlled, before moving into use within the general application.

Examples of this are already in play in other areas of Latin America. Mexico’s Law to Regulate Financial Technology Institutions,

popularly known as the Fintech Law, addresses these and other aspects related to financial regulation. These including the handling of information flowing through Fintech services and its classification as open data (data that does not contain confidential information), aggregate data (statistical information of transactions at a group level, without the ability to identify individuals) and transactional data (related to the use of a product or service). These supplementary regulations are accompanied by authorization stages in which users must grant permission for their data to be shared.

The relevance of these types of changes would allow El Salvador to put itself on the global map for progressive technology use

and, very importantly, facilitate the participation of more financial actors to provide a greater array of products and services to

sections of society who have historically not had access to banking.

We consider El Salvador to have two key factors for the successful adoption of cryptocurrencies. The first is that nearly a quarter of the Salvadoran population receives remittances that are currently expensive to send. The cost of this vital financial source could be significantly reduced with the implementation of cryptocurrencies as legal tender, allowing payments to go through digital wallets instead of sending remittances via financial institutions.

Secondly, experiments of this type of economic dynamics have been carried out in beach sector, where its residents have made a gradual transition of their economy to cryptocurrency. This move has been viable when the population is duly informed regarding the use of said financial assets.

We consider that this is a good time to broadly analyze the phenomenon of Fintech and take the opportunity to generate a regulation that not only covers points already contemplated in other countries, but also establishes the most advanced policies possible for the healthy growth and development of this industry in our country.

Honduras

Central Law

Collaborating Firm of Andersen Global

In Honduras, the regulation of Fintech is very recent and is still under development by the competent authorities. What is understood

by Fintech is limited to the services of money and electronic transactions of debit accounts, electronic wallets, payments of goods and services, transfers, and payments between users.

The National Banking and Insurance Commission (CNBS) is working on a new regulation framework for electronic payment services

that will replace the current regulation for non-banking institutions that provide payment services using electronic money (INDEL).

The purpose of this regulation is to control the authorization and operation of private and public non-banking institutions that carry out

transfers and payment transactions of goods and services by using mobile devices, with funds owned by its users, transformed into

electronic money, in the national territory.

Within the incorporation and application requirements, the CNBS, prior to the admission of the application, will also request that it must

be accompanied by a statement indicating that it has its own or subcontracted technological infrastructure required for the operation of

the Mobile Transaction Circuit (CTM).

Once the request for authorization is admitted, the petitioners must publish on their own account in two newspapers of major circulation in the country, a summary of the main elements related to the request for authorization, according to the information provided.

The CNBS will verify the origin, source and legitimate ownership of the resources and must reasonably ascertain that the partners have a patrimony in assets, equivalent to, at least three times the amount of the contribution they intend to make to the capital of the

company in formation, which must be a fixed capital and not less than US $1,230,000.00.

Obligations and Liabilities

The INDEL’s may constitute up to two trusts in authorized banking establishments, guaranteeing that the balance of these trusts

corresponds to at least 100% of the electronic money put into circulation by INDEL’s, whose exclusive purpose will be to back up the electronic money in circulation in the CTM. The constitution of the trusts becomes a guarantee for the participants; therefore, they must be always in force. When establishing two trusts, they must be constituted in different banking institutions.

The interest generated by the trusts will be imputed to cover the costs and expenses related to the administration of the Trusts.

If there is a remainder after covering these costs, it will be transferred to the said to cover eventual future costs derived from the administration of the trusts and will not be freely available to the trustor. The interest accrued over time will be used in accordance

with the regulations issued by the Central Bank of Honduras (BCH).

The constitution of the trusts and any modification thereof must have the prior approval of the BCH, which may request the opinion of

the CNBS when it deems it necessary.

Rules For the Supervision of INDEL’s

The purpose of these rules is to establish the supervisory guidelines that will be applicable to the operations carried out by Non-Banking

Institutions that provide payment services using electronic money.

INDEL’s must keep their assets segregated from the resources they receive from their agencies and authorized transaction centers for the purchase of electronic money. For these purposes, they shall establish in the Procedure and Operation Manual of the CTM, the compensation mechanisms or tools to be used.

INDEL’s will have the obligation to send to the CNBS, on Monday of each week, the daily balances of the trust assets and the total of obligations pending payment in the CTM, corresponding to the immediately preceding week. Likewise, within the first 10 working days after the closing of each month, they must send reports on operations carried out in the CTM as well as any incidents reported therein.

Mexico

Andersen in Mexico

Member Firm of Andersen Global

SKATT

Member Firm of Andersen Global

From a tax perspective, Mexico has not had significant evolution to establish specific regulation applicable to Fintech’s since the

issuance of the Law applicable to the companies of this industry in 2018.

This creates different challenges for those offering and receiving services through these entities since, depending on the different

types of products, applications, processes and electronic business models established by the Fintech companies, we could be facing tax treatment clearly defined by tax provisions in cases of transactions that parallel those conducted in the traditional financial sector or before a tax regime that is not specifically defined for the novel products to be implemented by Fintech companies.

Considering the above, the most relevant aspects of the Mexican tax system with regards to the operation of Fintech operations

in Mexico are the following:

Fintech Entities Are Not Considered Part of the Financial System For Tax Purposes Firstly, it is important to mention that in general

terms, Fintech entities are not considered to be part of the financial system for Mexican tax purposes according to the Federal Tax Code

and the Mexican Income Tax Law. As a result, the obligations, rights, benefits, that among others, apply to the financial system do not

apply to Fintech entities, unless they qualify as a Multiple Purpose Financial Entity (SOFOM for its Spanish acronym, which is a sort of

non-bank bank), which are indeed considered to be part of a financial system provided that they observe certain requirements.

Income Tax and VAT

Fintech entities will, in most cases, be taxed under the general regime established by the Mexican Income Tax Law for corporations

and under the same rules that apply to them in general.

For VAT purposes, the recognition of the tax on the revenues and expenses incurred will be based on the cash flow under the same criteria, conditions and effects that apply to the activities conducted regularly without a specific or different regime.

In the case of Fintech’s that are not part of the financial system for tax purposes, the interest revenue generated derived from commercial credits will be subject to VAT and not enjoy the exemption established for entities of the financial system. Similarly, in the case of consumption credits, the corresponding VAT shall be recognized on the total amount of interests instead of on the real interest (minus inflation) as it applies to financial institutions.

Customer Transactions

The biggest grey area on the tax aspects of Fintech’s operations relates to the payments made to the customers. Financial institutions

currently make a series of payments to their customers, which the Mexican tax provisions clearly define the nature and classification of

the revenue earned by the customers, such as interests, capital gains, lease, etc.

Similarly, the tax provisions deal with the mechanic to quantify the customers’ revenue or expenses, in addition to establishing that

in most cases, the financial institution shall deliver a certificate for the proper recognition in their annual tax return, which is even

provided to the tax authorities beforehand. In this sense, the tax provisions also establish specific mechanisms to withhold income

tax, which are not applicable to most Fintech entities, such as the withholding on capital for those accounts that generate interests.

In the case of operations conducted with Fintech entities, the tax treatment application to any given transaction shall be defined

by the customers without there being full knowledge of the tax effects generated in a lot of cases, such as the sale of a crypto asset, fundraising through crowdfunding platforms, the recognition of revenue on diverse investment structures, as well as the resulting

formal obligations, such as the issuance of invoices on interest revenue. Without a doubt, this poses a risk for the customers to give the transactions the proper tax treatment and even have omit income tax and/or VAT payments. This can be exacerbated with the

rapid evolution of both the business models and the transactions themselves, so the identification of their nature and conceptualization

complicates the interpretation and application of the tax provisions even more.

Furthermore, there is no specific mechanism for Fintech companies to document these payments, which could generate unforeseen

administrative burdens with regards to obtaining tax invoices or not having the expenses incurred adequately supported and posing

a risk in the corresponding deduction of the payments made to the customers.

FATCA & CRS

Fintech companies shall conduct an analysis to determine if FATCA and CRS regulations enforced in Mexico should apply to them

since the definition of financial entity for FATCA and CRS purposes is much broader and comprises a larger number of entities than those that make up the financial system for tax purposes.

Nicaragua

Central Law

Collaborating Firm of Andersen Global

The term Fintech has aroused much interest in recent years for investors, financial institutions, academic centers, entrepreneurs, and regulatory entities that seek to provide security to users of technological solutions.

Examples of Fintechs can be found in services such as means of payments and transfers, alternative financing, personal finance and wealth management, business finance, trading of financial assets and stock market, credit risk, back office or digital identity, to mention some.

In Nicaragua, in recent years, a few initiatives have been launched for financial inclusion with the aim of promoting the banking of the

country, however, specific strategies have not yet been implemented to promote the development of financial inclusion solutions through of Fintech startups or access to financing through capital or alternative methods.

Fintech Regulation

Currently Nicaragua does not have a law that governs Fintech companies in a codified manner. Given this scenario, the regulations

that apply to Fintech in Nicaragua will depend on what type of company it is. It can be a company that develops technology for financial entities (traditional conception of Fintech), or one that, through technology, provides services comparable to those provided by financial entities.

In this sense, all Fintechs must comply with the implementation and practice of policies for the prevention of money laundering,

financing of terrorism and financing of the proliferation of weapons of mass destruction, as provided in Law No. 977 (only available

in Spanish), the which in its art. 32 states that it will regulate -among others- the activity of buying and selling services or currency

exchange, as well as the financial technology of payment and virtual asset services.

In this line, the Central Bank of Nicaragua issued in 2020 Resolution No. CD-BCNXLIV-1-20 (only available in Spanish) the regulation of financial technology providers of payment services, which arises with the purpose of regulating the authorization process for financial technology providers of payment services.

Said regulation regulates the following activities: digital wallets, mobile points of sale, electronic money, virtual currencies, purchase, sale and exchange of currency electronically and transfer of funds.

Companies engaged in these economic activities could also be subject to the provisions of the Personal Data Protection Law as well as the Law on Protection of the Rights of Consumers and Users, among others.

PANAMA

Central Law

Collaborating Firm of Andersen Global

Introduction

Financial intermediation is one of the fundamental pillars of the Panamanian economy, it represents about 7.2% of GDP, financial

and banking services in Panama have been characterized by their rigidity, robustness, and formality, which guarantees and provides legal certainty to all users of the banking system.

However, because of COVID-19, financial services were affected, as were the services of the International Banking Center, precisely

due to the rigidity and lack of regulation in new technologies.

Panama Banking System

It is regulated and supervised by the Superintendence of Banks, whose main objective is to ensure the soundness and efficiency of the

Panamanian banking system. The Vision of the Superintendency of Banks is to maintain a competitive International Banking Center that contributes significantly to the country’s economy and is a guarantee of the stability of the economic and monetary system, outlining

the guidelines, regulations, and proposals for the modernization of the system in today’s digitized world.

Banking Law and Its Modernization

The Banking Law dates to 1998, which has undergone minor modifications on different occasions; however, to date it has not been

updated or modernized in a comprehensive manner, which is key to the development of the Fintech ecosystem in Panama.

The Superintendency of Banks is currently working on a bill that seeks to develop the regulatory framework of legal vehicles and

financial services that complement Panama´s international offer, including Specialized Financial Entities, for the development of electronic wallets, digital currency providers, payment management systems, applications to send and receive money, among others.

Fintech at Present

Fintech has been gaining ground in the world and Panama does not escape from it, in fact, for several years many technological platforms have been developed with great success, despite the lack of regulation. Mainly platforms for sending and receiving money,

electronic wallets and digital payments.

COVID-19 promoted the development of e-commerce and with it, the development of new technologies, which are here to stay, and we see that they will gain ground in the financial sector in the short and medium term.

Conclusions

Although Panama does not have a specific regulation on Fintech, this has not been an impediment to the development of sophisticated platforms; however, we consider fundamental a regulation that modernizes the Panamanian financial system and formalizes the matter, strengthening investment, innovation, the development of new technological platforms and the attraction of new investments in this area.

Perú

Picon & Asociados

Member Firm of Andersen Global

The opening of the financial technology market in Peru has been growing in recent years. Thus, it was reported that only in 2017, the

Fintech market reached 47 companies, a figure that by 2021 increased significantly, reporting a total of 132 companies inserted in

this area.1

The fast growth of the digital financial sector raises the immediate question of whether the regulation in the country is sufficiently clear

and precise to contribute to the development and expansion of the Fintech business.

Legal Framework

Even though the development of Fintech companies is increasing in Peru, there has not yet been a specific regulatory development for them, which would allow for a direct and precise definition of the regulatory framework applicable to this sector.

In this sense, although in the last few years there has been an interest in the possible regulation of these activities, a special

general law has not been drafted to provide a clear definition of these activities, their modalities, guiding principles, respecting the business model and in accordance with their essential particularities.

Notwithstanding the above, it should be noted that there have been small regulatory developments in specific and reduced areas of the

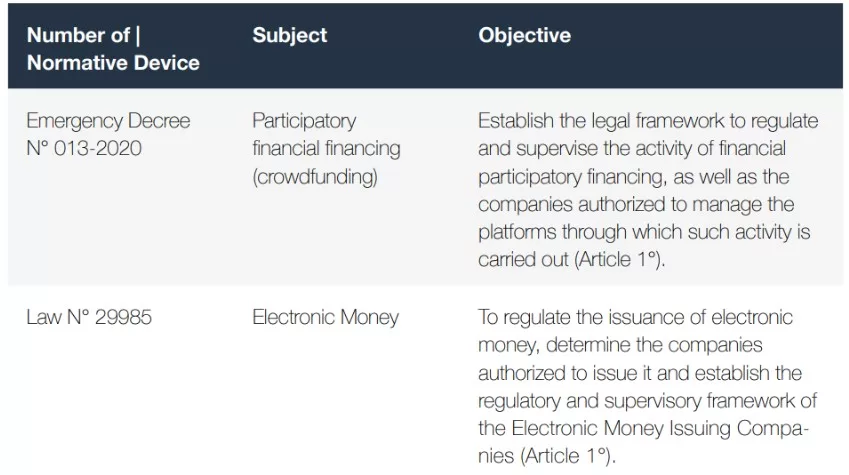

digital financial world. Thus, we can find two laws oriented to regulate electronic money and crowdfunding under the following terms:

Tax Framework

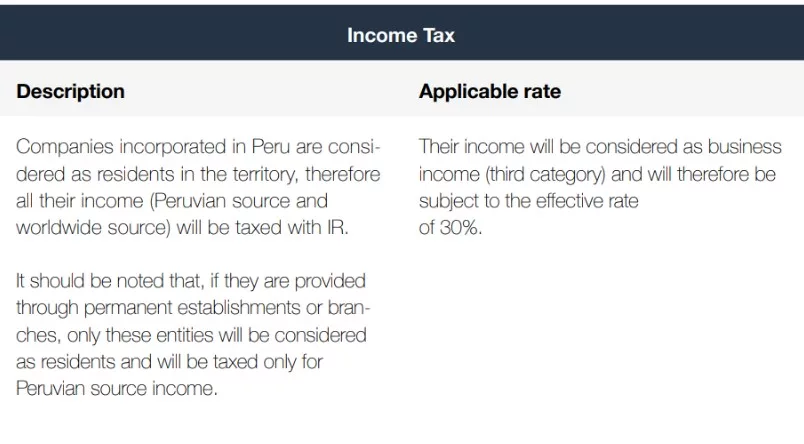

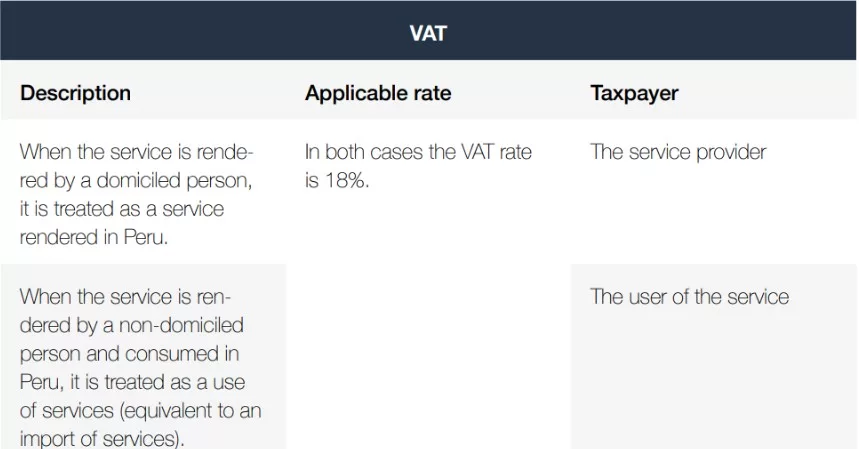

The activities carried out by Fintech companies are subject to the tax regulatory framework contained in the Income Tax Law (Supreme Decree N° 179-2004-EF) and the General Sales Tax Law (Supreme Decree N° 055-99-EF9). In this sense, the tax treatment granted to the services provided by these companies is as follows:

Uruguay

Andersen in Uruguay

Member Firm of Andersen Global

Uruguay has a long history of economic and political stability and one of the lowest crime rates of Latin America and the Caribbean.

These factors, combined with a safe banking system and interesting tax regime, made the emergence of Fintechs possible in the country.

Regulatory Aspects of Fintechs in Uruguay

From a regulatory point of view, our country has no specific rules like other countries in the region. As the use of technology applied to

finance affects aspects related to consumer protection, personal information protection, cybersecurity, and anti-money laundering,

the same principles and rights stipulated in the general regulatory framework shall be applicable to the companies of the sector.

On the other hand, the Central Bank of Uruguay grants a specific license named Management Companies of Collective Financing Platforms for companies operating platforms for loans among persons involving peer-to-peer lending and crowdfunding.

With regard to virtual assets, two bills being discussed in the Parliament and the Central Bank of Uruguay formed an internal Working

Group on Virtual Assets, which in December 2021, issued a conceptual framework for the future regulatory treatment of the virtual

assets in Uruguay.

Tax Aspects of Fintechs in Uruguay

The tax system for the activity is not specific, but actually framed within the general taxation regime.

Concerning business income, it is worth mentioning that Uruguay taxes the income generated in Uruguayan territory, and not that obtained in foreign countries.

The corporate income tax (IRAE) is currently levied at the rate of 25% and the Value Added Tax (IVA) is levied at the rate of 22%. Uruguay has a free trade zone regime through which a significant number of Fintech companies conduct their business operations from

Uruguay to the region and the world.

Free Trade Zones are specific geographical areas with a special regulatory framework: those companies operating from those enclaves are exempted from all taxes. The law guarantees exemptions for current and future taxes. The only requirement a company needs to meet to operate in a Free Trade Zone is that 75% of its workforce is local (upon authorization, such percentage may be

reduced to 50%, in the case of services).

We also consider it relevant to mention that software development operations and related services are ruled by a special system with

significant tax exemptions which encourages the creation of companies in the technological sector in Uruguay. Income arising from the

lease, use, assignment of use, and sale of software is tax-exempt provided that these are covered by intellectual property regulations,

developed in the Uruguayan territory and that result in registered assets. Moreover, the provision of software-related services shall be

completely tax-exempt as long as the activity is developed within the country.

The mentioned tax benefits and Uruguay’s opening to the world have caused Uruguayan Fintech companies to take off in the country

and abroad.

Venezuela

Leĝa

Collaborating Firm of Andersen Global In January 2021, the Superintendencia de las Instituciones del Sector Bancario, or SUDEBAN, issued Resolution no. 001.21, providing regulations for financial services offered by Fintech institutions through innovative technologies.

Authorization

This resolution provides the procedures that Financial Tech Institutions of the Banking Sector (ITFBs) are required to follow to operate in a lawful and adequate manner. From a corporate aspect, ITFBs are required to be incorporated as limited companies (S.A.), with registered shares of the same nature, and have a minimum of five shareholders, domiciled in Venezuela, and a corporate purpose of providing financial services through new and innovative technologies.

From a regulatory aspect, the ITFBs require a formal authorization issued by SUDEBAN to operate and a favorable opinion of the

Superior Body of the National Financial System (OSFIN). They are also required to maintain a performance bond of no less than the equivalent of EUR €20.000.

Terms and Deadlines

ITFBs are required to begin operations within 120 business days, after being authorized. They can however apply for an extension of

another 90 days.

Requirements for Authorization

The requirements for shareholders include: an affidavit regarding whether they have taken part or not in executive/directive, administrative and/or management positions in banking institutions, and if, while in that position, either the Institution or themself was

involved in any judicial proceeding; personal balance sheet and income certification for the last two accounting/fiscal periods (in the case of legal entities, income statement and balance sheet for the last two accounting/ fiscal periods, prepared by a public accountant); two personal and banking references respectively, no older than three months from its expedition date; and income tax declaration from the last three years with evidence that supports said payments.

The requirements for limited companies or corporations submitted for authorization, shall also have a copy of the bylaws with its

latest modifications duly registered. There should be evidenced, among other elements, the corporate name, domicile, duration, corporate purpose, corporate capital, shareholding structure, and identification of the administrators.

Approved Services

Services approved by the Sudeban for ITFBs are:

• Products for the payment and storage of money

• Products within banking institutions

• New business models

Obligations

In relation to the administration of third-party funds, ITFBs are required to keep their resources segregated from those of their clients and maintain a record of accounts on transactional movements. They must provide the means, so the transfer of funds received from the client to their account in a banking institution is carried out within the next business day following the reception of said funds and guarantee that the funds received are available to clients at all times.

Cessation, Suspension and Revocation of Activities

In the event an ITFB intends to cease its activities, it must provide notice at least 90 days in advance. SUDEBAN should approve within 30 days from notice. If necessary, the Sudeban can take up to an additional 30 days. Regarding suspension or revocation, such cases shall be approved by SUDEBAN after being analyzed by the competent national authority on financial systems (OSFIN) in

accordance with the regulations.